In just over a decade, digital currencies have evolved from obscure concepts to global disruptors. As cryptocurrencies and central bank digital currencies (CBDCs) gain momentum, many are asking: Is the future of money entirely digital—and ultimately cashless?

The Rise of Digital Currencies

Digital currencies are not just one thing—they exist in multiple forms:

- Cryptocurrencies like Bitcoin and Ethereum, which operate on decentralized blockchain networks

- Stablecoins, pegged to fiat currencies to minimize volatility

- CBDCs, issued and regulated by central banks as a digital form of national currency

Each type plays a different role, but all share a common trait: they are reshaping how we think about money, transactions, and trust.

Fast Facts:

- Over 420 million people worldwide used cryptocurrencies as of 2024

- More than 130 countries are exploring or developing CBDCs

- Digital payments have surpassed cash usage in several major economies

Drivers of the Shift to Digital Money

Several factors are fueling the exponential growth of digital currencies:

1. Technological Advancement

Blockchain, mobile internet, and cloud computing have made it possible to create secure, transparent, and fast digital financial systems.

2. Changing Consumer Behavior

Younger generations, especially Gen Z and Millennials, are more comfortable with digital wallets, QR payments, and app-based banking.

3. Global Financial Inclusion

Digital currencies can offer banking access to the unbanked population—especially in developing regions where traditional infrastructure is lacking.

4. Macroeconomic Trends

Inflation concerns, geopolitical instability, and currency devaluation have led people in some regions to seek alternatives to traditional fiat currencies.

Benefits of a Cashless Future

A move away from cash offers several compelling benefits:

- Convenience: No need to carry physical money or visit ATMs

- Security: Reduces risks of theft and loss

- Transparency: Digital transactions are easier to trace, which helps combat fraud and money laundering

- Efficiency: Speeds up transactions and reduces operational costs for businesses and banks

In the case of CBDCs, governments could also deliver financial aid or stimulus packages instantly and more directly.

Risks and Challenges

However, a cashless future isn’t without drawbacks:

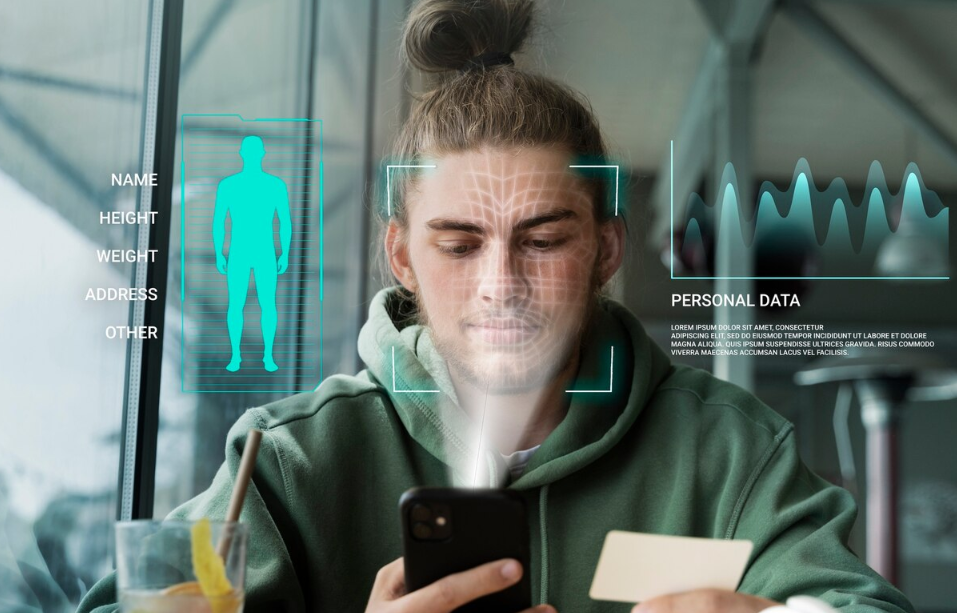

1. Privacy Concerns

Digital transactions are trackable. Without proper safeguards, they could lead to excessive surveillance or misuse of personal financial data.

2. Digital Divide

Not everyone has access to smartphones or the internet. A fully cashless society could marginalize certain groups, especially the elderly or rural populations.

3. Cybersecurity

Hacking, digital fraud, and system outages could disrupt economies if adequate cybersecurity measures are not in place.

4. Volatility and Regulation

Cryptocurrencies remain highly volatile. Regulatory uncertainty adds another layer of risk for users and investors alike.

Central Bank Digital Currencies (CBDCs): Bridging the Gap

CBDCs aim to combine the advantages of digital currency with the trust of traditional fiat. They could:

- Offer a stable, government-backed digital payment method

- Improve monetary policy implementation

- Reduce reliance on private cryptocurrencies

Countries like China (with the digital yuan) and Sweden (with the e-krona) are already testing real-world CBDC use cases.

The Road Ahead: Hybrid Systems?

Rather than a sudden switch, the most likely scenario is a hybrid monetary system where:

- Cash continues to coexist with digital currencies

- Private and public digital payment platforms work in parallel

- New forms of programmable money emerge for specific use cases (e.g., smart contracts, automatic taxes, or expiration dates)

Final Thoughts

The exponential rise of digital currencies signals a massive transformation in the way we exchange value. While a fully cashless world may still be years away, the trend is unmistakable: money is going digital.

Whether this future enhances financial freedom or tightens control will depend on how the digital economy is designed, governed, and accessed. What’s certain is that the age of digital currency has already begun—and there’s no turning back.