The rapid evolution of technology is breaking down traditional barriers between industries. One of the most fascinating intersections is that between biotechnology and financial technology (fintech)—two fields that, at first glance, seem worlds apart. Yet, the innovations from biotech are increasingly influencing the way we think about finance, security, identity, and the future of money.

The Convergence of Two Worlds

Biotech traditionally focuses on the use of biological systems and organisms to develop products or solve problems, especially in health and medicine. Fintech, on the other hand, aims to enhance or automate financial services and processes through technology.

So, how are these two areas overlapping?

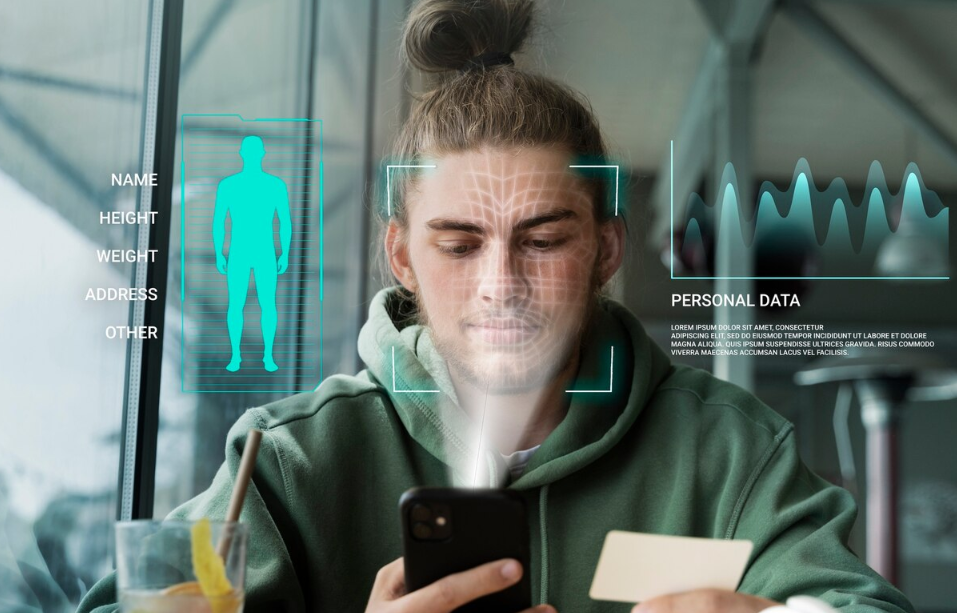

1. Biometrics and Identity Verification

Biotech innovations like fingerprint scanning, facial recognition, retina scans, and even DNA-based identification are redefining how people access financial systems. These biometric tools offer:

- Faster onboarding: Opening a bank account with a selfie or a fingerprint.

- Fraud prevention: Unique biological identifiers reduce the risk of identity theft.

- Secure transactions: Biometric authentication is harder to fake than passwords or PINs.

This technology is especially transformative in developing regions, where traditional identity documents may be unavailable.

2. Health Data Meets Financial Risk Models

Insurtech—an emerging subset of fintech—is leveraging biotech-derived health data to personalize insurance plans. Wearable devices like smartwatches and fitness trackers monitor heart rate, sleep, activity levels, and more. This data can be used to:

- Adjust life insurance premiums in real time

- Reward healthy behavior with financial incentives

- Detect fraudulent claims using physiological data

While this opens new opportunities, it also raises serious questions about privacy, consent, and data ownership.

3. Biotech Startups and Financial Ecosystems

Biotech companies themselves rely heavily on fintech for:

- Crowdfunding and micro-investments: Platforms allow everyday investors to support promising biotech projects.

- Blockchain for research integrity: Some biotech firms use blockchain to timestamp clinical trial results, ensuring transparency.

- Tokenized IP: Startups are experimenting with turning biotech patents into tradable digital assets.

The financial system is adapting to support these new, high-risk, high-reward ventures with more dynamic and decentralized funding models.

Ethical and Regulatory Challenges

Where biotech and fintech overlap, regulation often lags behind innovation. Critical concerns include:

- Data misuse: Who owns biometric and health data once it’s shared with financial institutions?

- Discrimination: Could access to financial products be limited by genetic or health conditions?

- Consent: Are users truly aware of how their biological data is being used?

Without clear guidelines, this convergence could create new forms of digital inequality.

The Road Ahead

The fusion of biotech and fintech points toward a future where your body could be your wallet, and your health could influence your financial access. Emerging trends to watch include:

- Bio-wallets: Payment systems based on biometric data alone.

- Genetic credit scoring: A controversial idea where health risks factor into lending decisions.

- AI-driven health-finance platforms: Integrating financial planning with personalized health predictions.

While these possibilities are exciting, they also demand thoughtful design, strong ethical standards, and global cooperation.

Conclusion

As technology blurs the lines between biology and finance, a new ecosystem is emerging—one where our most personal data fuels financial innovation. The key challenge will be balancing convenience, efficiency, and personalization with privacy, fairness, and trust. From biotech to fintech, the future of finance is not just about money anymore—it’s about people at the cellular level.